Market Analysis

Docebo reports, according to Ambient Insight, that worldwide revenues for GBL reached $2.6B in 2016, and the projected compound annual growth rate (CAGR) is 22.4%, with revenues expected to surge to $7.3 B by 2021. What’s driving growth? According to The Entertainment Software Rating Board, people of all ages report loving games. Over 67% of American households play computer or video games – while 26% of those are over the age of 50, it’s the 74% under the age of 50 who are moving into the workforce with their strong preference for games. According to Docebo projections, the education scene, in particular, GBL is seeing and will continue to experience, rapid adoption in classrooms across North America. (note, all dollars are U.S.)

Docebo reports, according to Ambient Insight, that worldwide revenues for GBL reached $2.6B in 2016, and the projected compound annual growth rate (CAGR) is 22.4%, with revenues expected to surge to $7.3 B by 2021. What’s driving growth? According to The Entertainment Software Rating Board, people of all ages report loving games. Over 67% of American households play computer or video games – while 26% of those are over the age of 50, it’s the 74% under the age of 50 who are moving into the workforce with their strong preference for games. According to Docebo projections, the education scene, in particular, GBL is seeing and will continue to experience, rapid adoption in classrooms across North America. (note, all dollars are U.S.)

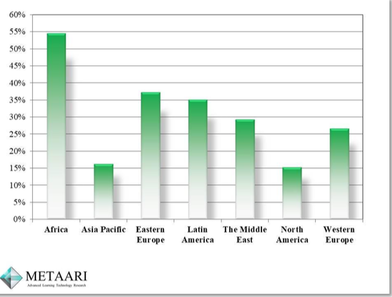

Figure 1. 2017-2022 Game-based Learning Growth Rates by Seven Regions

Figure 1. 2017-2022 Game-based Learning Growth Rates by Seven Regions

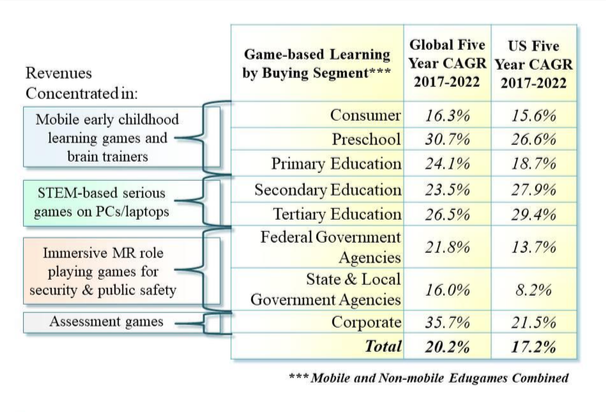

Another market analytic, Metaari, reports through analyst Sam S. Adkin's report, "The 2017-2022 Global Game-based Learning Market, July 2017," that game revenues are projected to spike to $8.1 Billion by 2022. The five-year compound annual growth rate (CAGR) for game-based learning products on the planet is 20.2% and revenues will more than double to $8.1 billion by 2022, up from the $3.2 billion reached in 2017. There are two sections in this report: a demand-side analysis and a supply-side analysis. The demand-side analysis provides revenue forecasts for seven regions, thirty-nine countries, as depicted in the figure to the left. Seven key regions: Africa, Asia Pacific, Eastern Europe, Latin America, the Middle East, North America, and Western Europe. Africa will experience the highest growth rate of all the regions at a breathtaking 54.4%, followed by Eastern Europe and Latin America at 37.3% and 35.1%, respectively.

The top buying countries are identified in each region and five-year revenue forecasts are provided for thirty nine countries including three in Africa, nine in Asia Pacific, six in Eastern Europe, six in Latin America, four in the Middle East, two in North America, and nine in Western Europe. For the benefit of focus of emerging market potential, a detailed demand-side analysis by eight buying segments and supply-side analysis by eleven serious game categories is provided for just the United States, as indicated below, in Figures 2 and 4, respectively. The US analysis identifies very favourable revenue opportunities for game based learning developers with preschool, primary and secondary markets showing a five year projection increase of 26.6%, 18.7%, and 27.9%,respectively.

The top buying countries are identified in each region and five-year revenue forecasts are provided for thirty nine countries including three in Africa, nine in Asia Pacific, six in Eastern Europe, six in Latin America, four in the Middle East, two in North America, and nine in Western Europe. For the benefit of focus of emerging market potential, a detailed demand-side analysis by eight buying segments and supply-side analysis by eleven serious game categories is provided for just the United States, as indicated below, in Figures 2 and 4, respectively. The US analysis identifies very favourable revenue opportunities for game based learning developers with preschool, primary and secondary markets showing a five year projection increase of 26.6%, 18.7%, and 27.9%,respectively.

|

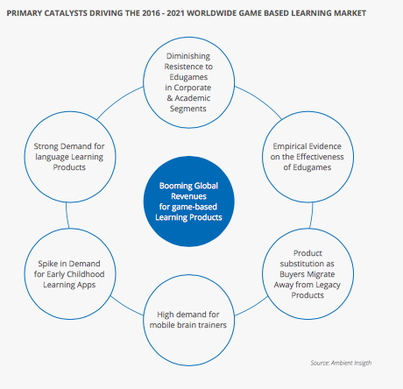

Primary Catalysts Driving the Global Educational Games Market

Further insights into market growth, according to Metaari, identify six primary convergent catalysts driving the global educational game market:

|

|

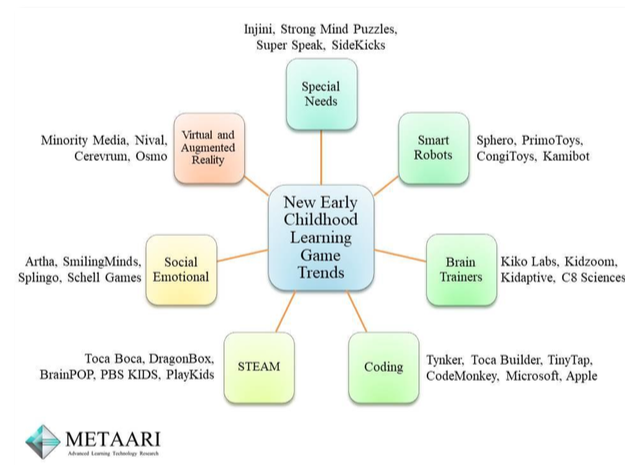

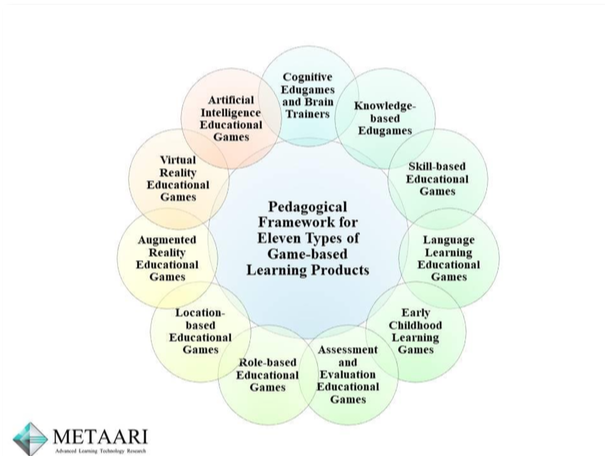

The forecasts in the Metaari report break out revenues by eleven distinct educational game types based on Metaari's pedagogical framework, as represented in Figure 4 to the right. The educational game framework provides suppliers (game developers) with a precise method of tapping specific revenue streams and a concise instructional design specification for the development of pedagogically sound effective educational games. Without a doubt, early childhood learning games are the top revenue generating educational game throughout the forecast period, followed by brain trainers, language learning games, and knowledge-based educational games. The million dollar two-fold question is: What is the best market segment to focus on and what revenue model is best suited to this hot emerging market? |

|

Figure 4. Framework for Eleven Types of Game-based Learning Products

|

Citations:

Docebo, 2016, eLearning Market Trends and Forecasts. https://eclass.teicrete.gr/modules/document/file.php/TP271/Additional%20material/docebo-elearning-trends-report-2017.pdf

Metaari, July 2017, Global Game Based Learning Market. http://seriousplayconf.com/wp-content/uploads/2017/07/Metaari_2017-2022_Global_Game-based_Learning_Market_Executive_Overview.pdf

Docebo, 2016, eLearning Market Trends and Forecasts. https://eclass.teicrete.gr/modules/document/file.php/TP271/Additional%20material/docebo-elearning-trends-report-2017.pdf

Metaari, July 2017, Global Game Based Learning Market. http://seriousplayconf.com/wp-content/uploads/2017/07/Metaari_2017-2022_Global_Game-based_Learning_Market_Executive_Overview.pdf

* GBL International is a fictional company created for the sole purpose of teaching about Game-Based Learning.